Have you bought a car on finance?

If you did so between 2014-2020 you could be owed an average refund of £,3,000 per car in

compensation

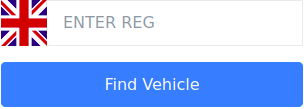

Check For Free Here:

Enter your licence plate number

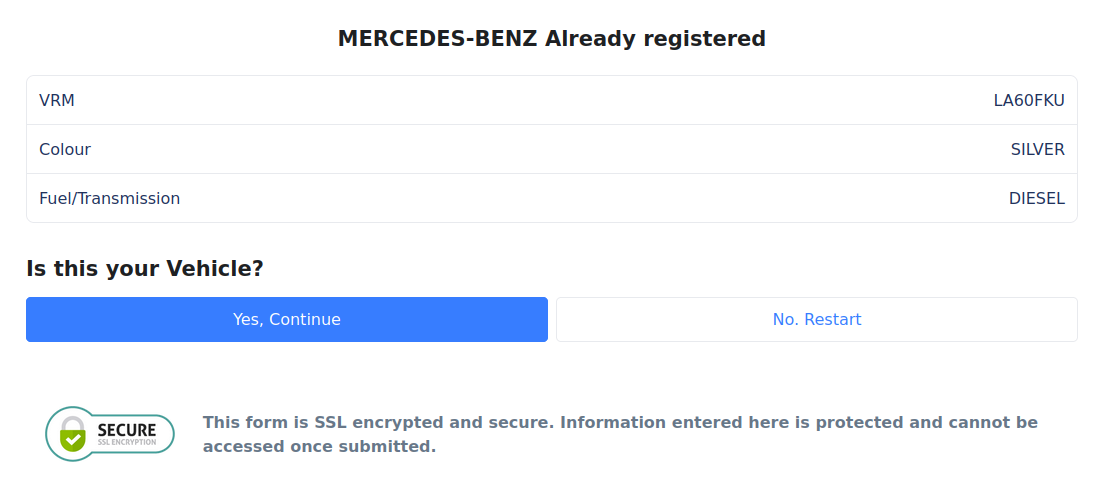

Is this your vehicle?

- Manufacturer

- Colour

- Fuel Type

Upload your ID card or passport!

Upload your Agreement files!

Provide your signature

Form has been filled out successfully!

No Win - No Fee Guarantee!

Over 350,000 Signed Up

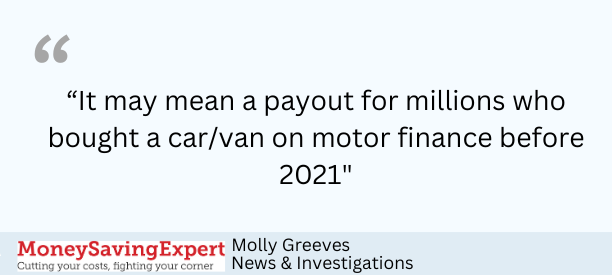

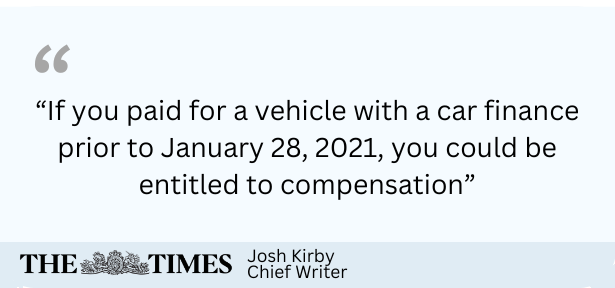

What the press are saying...

Have you been affected by 'mis-sold' PCP finance?

Countless drivers across the UK, much like yourself, could potentially be entitled to financial restitution following an inquiry by the FCA revealing excessive overcharging on their monthly finance payments.

You may qualify if:

- Your lender neglected to disclose commission fees or potential early repayment charges in your agreement.

- The interest rate tied to your agreement was influenced by these elevated commission fees.

- Your lender omitted to explain the complete terms of your finance deal, including the eventual cost of the vehicle at the deal's conclusion.

Fill out our quick and easy form

Start by entering your details into our simple form

Our expert gets to work

We have an experienced team of legal professionals, thoroughly analysing and pushing your claim

Get your funds back

Where we can successfully complete your claim. We will ensure your funds are transferred promptly

Frequently Asked Questions

Only people who took out finance on a vehicle between 2010 and 2021 can make a claim. To find out if your vehicle may have been affected, enter your registration number above.

You will be eligible if:

- Your car finance was a personal contract purchase (PCP) (which is a bit like a loan to help you buy the car); or

- A hire-purchase agreement (which is where you pay off the value of the car in monthly instalments).

To be included within our claim is fill out the information shown at the top of this page. We'll do the rest for you.

We believe that there is a high likelihood many people will be paid out for this claim, otherwise we would not choose to pursue the claim.

YThe amount of compensation you receive will depend on several factors including the amount of finance taken out and the interest rates charged. However, Our solicitors will work tirelessly to ensure you get the compensation you deserve.

If you took finance out to purchase a car between 2010 and 2021, you may be eligible to make a claim. Fill out our free form to find out. It only takes 60 seconds

No – Our solicitors are experts, so we do the hard work for you. Simply fill out your information in the forms above and we'll contact you if you need to do anything else.

Yes, you can register as many finance agreements as you took out from 2010 to 2021 if you have more than one finance agreement

The length of time it takes to finalise a claim can vary. However, our solicitors will work hard to ensure you get the compensation you deserve and will keep you updated throughout the process.

We operate on a no win-no fee basis which means there is nothing for you to pay if you aren't successful in the claim. If you are successful, we'll take a pre-agreed percentage as our fee.

Our specialist solicitors collective actions team are experts in this field. We recently helped more thousands of claimants in England and Wales to secure a settlement payment of millions winning extensive compensation for our clients.